Share Rates

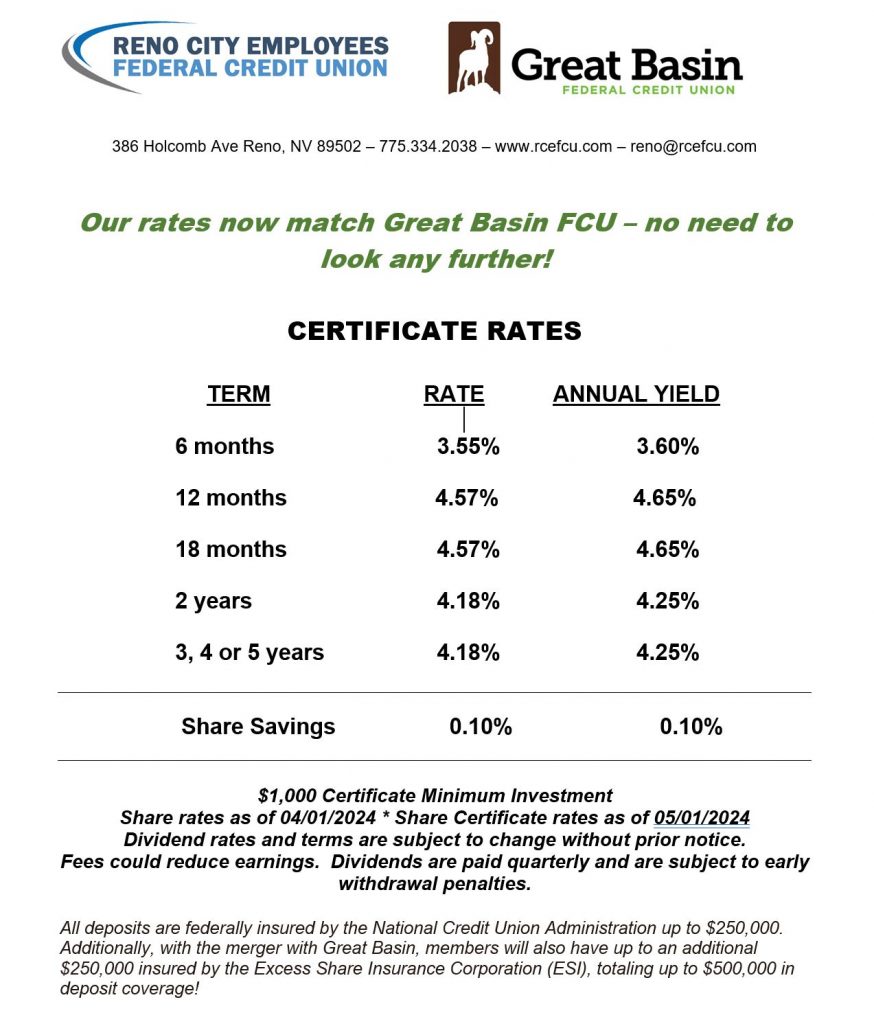

Savings Accounts ~ Daily Rate 0.10% ~ APY 0.10%

Checking Accounts ~ Daily Rate 0.00% ~ APY 0.00%

For other deposit products and rates now available to you with Great Basin FCU, click here.

APY = Annual Percentage Yield. Share rates as of April 1, 2024